Rossford Schools has a renewal operating levy with a tax REDUCTION on the Tuesday, May 6, 2025, ballot. It is a 4.9 mill levy that the board voted to put on the ballot as a decrease from 5.9 mill it was initially voted at in 2015 and renewed in 2020. This renewal levy, which includes a decrease, is for five years.

What happens if the levy fails?

Rossford Schools would lose the entire mileage which generates over $2 million annually beginning in January of 2026 – if this isn’t renewed before then. This would be a loss of over $8 million in revenue over the five-year duration of the levy. This would create financial uncertainty for the district’s current operations.

How much savings would I see in my taxes if approved?

Based on the median home value in Rossford, reducing the levy by 1 mill is estimated to save taxpayers $58.70 annually. Combined with the 2-mill reduction in 2022, the total estimated annual savings between all three reductions would be $176. *According to a report from David Conley of Rockmill Financial. Click here to see full report.

How long has this levy been collected?

This levy was first approved in 2015. It was renewed for another five years in 2020. The lev

y expires at the end of 2025.

What does this money fund?These levies provide for our student programming, which includes our inclusive services for all students, expanded programming, more course options, after-school clubs and more. It also will allow us to maintain staffing levels. In the past few years, we have added a school resource officer for each school, a school-family liaison, expanded counseling and reading intervention specialists. Since 2020 we have added 11 junior high school courses and 25 high school courses.

What are some of these programs?

We added an elementary music club and art clubs for 6-12 students. STEM programming has been added in all grades. We have expanded counseling services and college credit plus opportunities for our high school students to earn college credits.

Some of the new 6-12 courses we have offered include:

Language & World Cultures

Introduction to Theater

Current Events

Nutrition

Podcasting

21st Century Literacy

Video Game Design

Ceramics

Intro to Engineering

Bulldog Productions (video editing/producing)

Balancing Books (accounting)

Navigating Life in the Real World

Career Credentials

Financial Literacy

How rare is a levy reduction?

In the State of Ohio there have been three other districts to offer levy reductions to residents since 2020. Rossford Schools is the only district to offer multiple reductions. It offered 2 reduction renewal levies in 2022 which were passed by voters and is offering another one on May 6.

*According to Secretary of State Historical Election Results

What about the new middle school?

Rossford Schools has been blessed with tremendous commercial growth in its area providing enterprise zone funds which are commercial tax agreements that go toward our school district. These funds have put us in a position to build a new middle school WITHOUT having to go to voters for a bond levy. Similar to how The R was built.

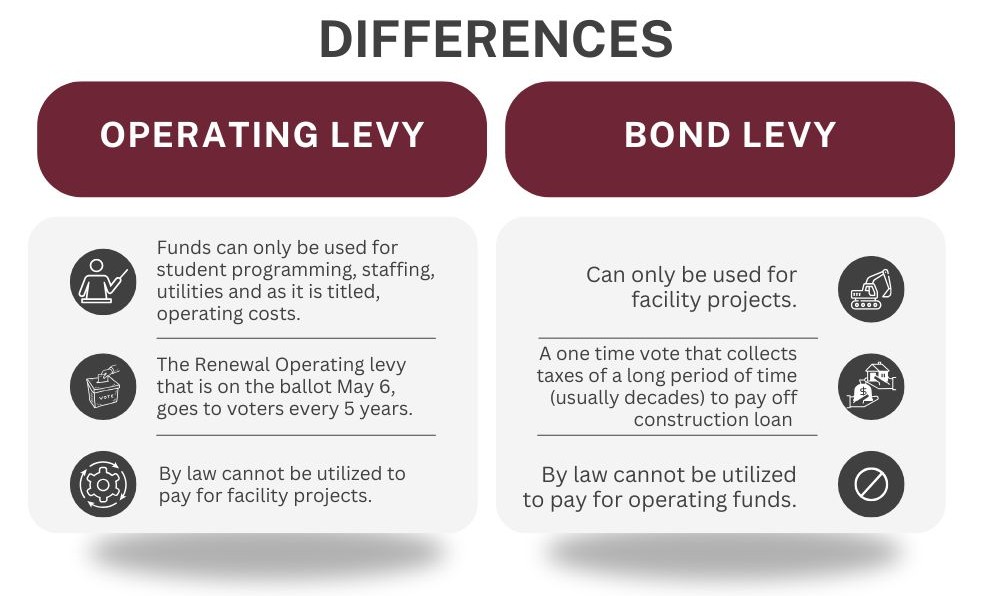

What is the difference between an operating and a bond levy?

Operating levies cannot fund facility projects, and likewise bond levies can’t fund operating costs. This operating renewal funds our staffing, programming and utilities. This levy does not affect the new middle school project.

How does voting yes to a tax lower my taxes?

These taxes have already been collected for the past 10 years at 5.9 mill. This tax, if approved, will lower how much money each homeowner will have to pay compared to previous taxes as the mill being requested is being reduced to 4.9 mill.

How can you sustain student programming and staffing with less money?

Rossford Schools has been fiscally responsible which has put the school district in a financially stable place. It is incredibly rare for a school district to lower taxes, but our financial decisions have put us in this position. Lowering utility and repair costs from our new facilities have also helped lower our operating costs on top of being fiscally responsible with spending.